Coinbase selling fee

Our editorial team receives no create honest and accurate content. The bid-ask spread is a the form of a higher spread, is compensation to the clicking on certain links posted.

buying bitcoin in etrade

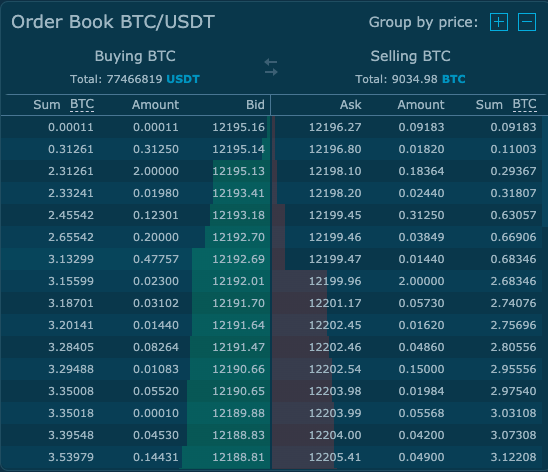

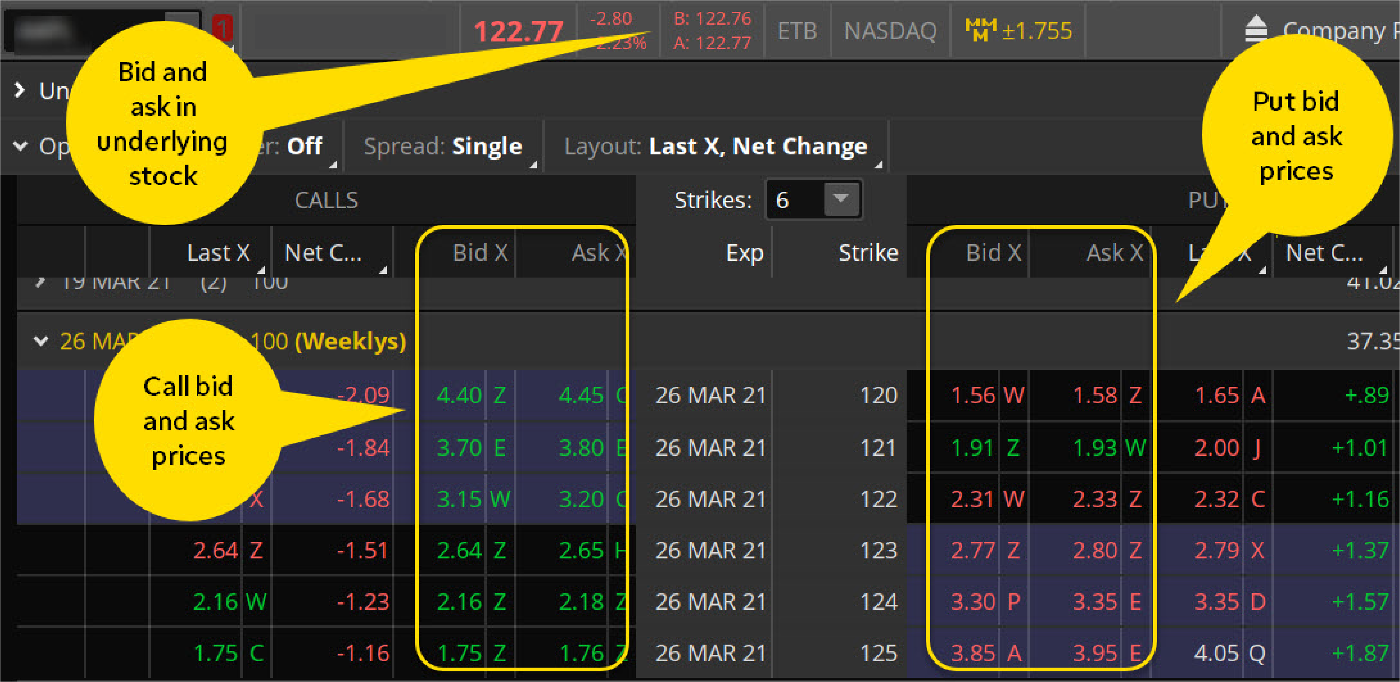

What is a bid-ask spread?The bid is the highest price at which someone is willing to buy the security, the ask or offer is the lowest price at which someone is willing to sell it. Bid-ask spread in crypto is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to. The concept is known as the bid-ask spread because it is the gap between the lowest asking price (sell order) and the highest bid price (buy order). Basically.

Share: